Efektivní řešení v oblasti profesionálního outsourcingu

Nechte starosti s výrobou, logistikou a kontrolou kvality na nás.

Jsme nejlepší

v tom, co děláme

Tým společnosti Solveo pracuje na vytváření jedinečných řešení, která pomáhají zvýšení efektivity u našich zákazníků. Vážíme si dlouhodobých vztahů s našimi zákazníky, které jsou založené na produktivitě a otevřenosti.

S vámi

už 23 roků

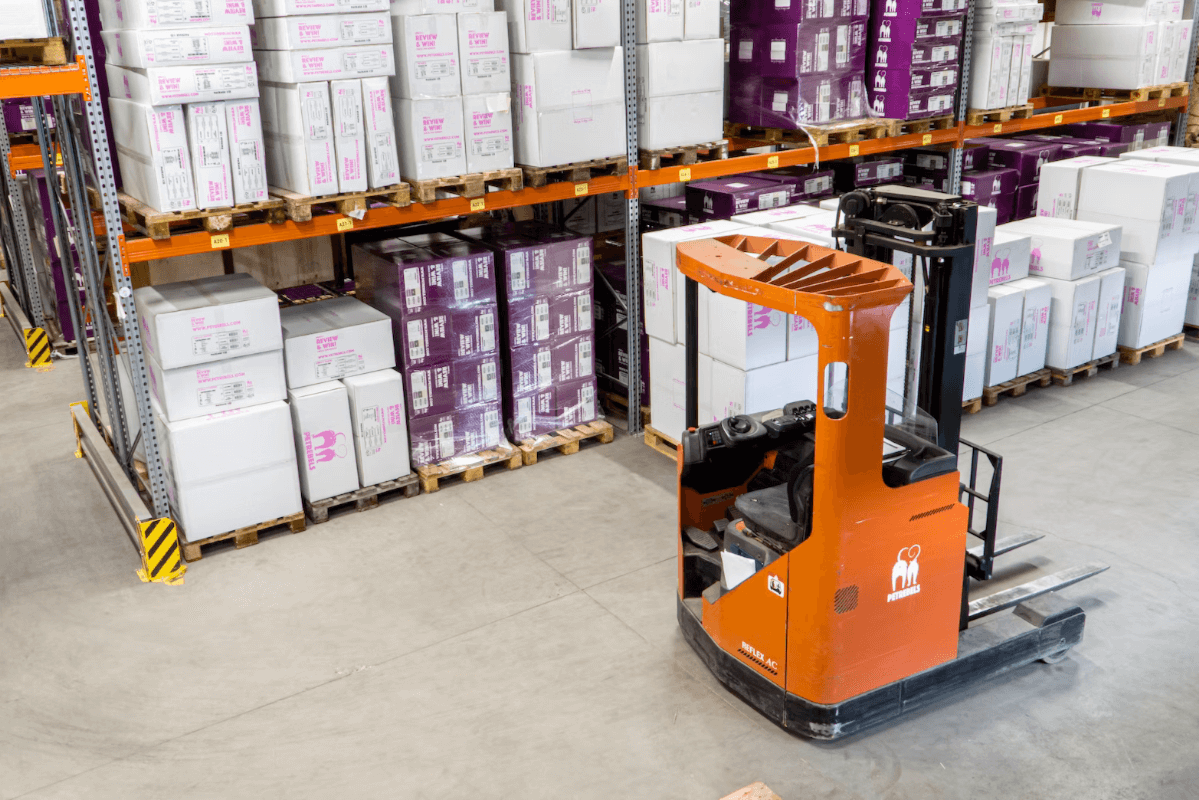

Outsourcing

mnoha odvětví

Outsourcing kontroly kvality

Outsourcing logistiky

Příběhy našich klientů

rádi bychom poskytli oficiální doporučení pro služby poskytované firmou Solveo s.r.o.

Od začátku roku 2010 naše společnost TEKNIA Uhersky Brod a.s., spolupracuje se společností Solveo s.r.o. na výstupní kontrole koncových výrobků s cílem zajištění kvality našich produktů.

Společnost Solveo je flexibilní, rozumí našim potřebám a mimo dobře odvedenou práci, zejména v zachycení procesních vad a eliminací reklamací, je schopna navrhovat řešení na míru. S ohledem na průběh spolupráce můžeme společnost Solveo s.r.o. doporučit pro zákazníky, kteří hledají spolehlivého partnera ke kontrole kvality nebo v projektech kooperace.

Velice ráda touto cestou potvrzuji naši celkovou spokojenost se spoluprací se společností Solveo.

Pracovníky ze Solvea řadíme k našim nejlepším třídícím pracovníkům.

Za celou dobu naší spolupráce tj. od roku 2017 (ještě pod názvem Faria) jsme neměli žádné problémy

s organizací, s koordinátory ani se samotnými pracovníky.

Doufáme, že i nadále bude spolupráce s touto firmou tak dobrá, jako dosud.

Firmu Solveo tak můžu doporučit i dalším zájemcům o spolupráci.

Firma Solveo - dodavatel třídících služeb pro naši společnost je vnímána jako velmi kvalitní dodavatel těchto služeb s proaktivním přístupem k požadavkům zákazníka.

Se společností Solveo aktuálně spolupracujeme na projektu mobilního servisu a úklidu sítě unikátních samoobslužných boxů OX.point. Od května 2021 v rámci hlavního města Praha, s plánem se rozšířit nejen

po celé České republice.

Rozhodl jsem se pro tuto společnost, protože ji známe již z předchozích projektů, pro jejich flexibilitu

a kvalitu odvedené práce i schopnosti proaktivně reagovat na požadavky či změny.

Z výše uvedených důvodů doporučuji společnost Solveo jako spolehlivého partnera.

Chtěl bych využít příležitosti a poskytnout formální doporučení na služby společnosti Solveo s.r.o.

Od začátku roku 2020 naše společnost RITCHY EU s.r.o. spolupracuje se společností Solveo s.r.o. na mnoha projekty související s výrobou. Odezva, kterou získáte od společnosti Solveo, a osobní pozornost, kterou poskytují, jsou hnací silou úspěchu, kterého jsme dosáhli od začátku naší spolupráce. Tým Solveo je motivován výzvami a díky tomu se nám podařilo zvýšit flexibilitu, zavést aizaci, outsourcovat část výrobních činností a snížit výrobní náklady.

Solveo má z obchodního hlediska jedinečné umístění, rozumějí obchodní potřeby a nabízejí řešení šitá na míru pro mnohé obchodní případy. Spolupráci se Solveo bych doporučil, pokud hledáte spolehlivého partnera pro outsourcing vaší výrobní aktivity.

Volné pracovní

nabídky

Technik kvality

Pro náš interní tým v oblasti kontroly kvality hledáme nového kolegu/kolegyni na pozici Technik kvality pro úzkou spolupráci s klientem, nastavování zakázek a vedení týmu. Co nabízíme: Náplní Vaší práce bude: Naše očekávaní od kandidáta:

Zobrazit víceKey Account Manager

Společnost Solveo s.r.o., člen skupiny Manuvia přivítá nového kolegu/kolegyni na pozici Key Account Manager, jehož/jejíž hlavní odpovědností bude rozvoj obchodních aktivit v oblasti outsourcingových služeb.

Zobrazit více